SEC Amends Beneficial Ownership Reporting Rules, Shortening Deadlines and Offering Guidance on "Groups" and Cash-Settled Derivatives

October 25, 2023

On October 10, 2023, the Security Exchange Commission ("SEC") adopted amendments to the rules governing the reporting of beneficial ownership of securities (the "Final Amendments") under Sections 13(d) and 13(g) of the Securities Exchange Act of 1934 (the "Exchange Act"). In addition to these changes, the SEC issued guidance on the disclosure of cash-settled derivatives and group formation.

Sections 13(d) and 13(g) of the Exchange Act establish certain ownership reporting obligations. These rules apply to any individual or group of persons who directly or indirectly acquire or hold beneficial ownership of more than 5% of a covered class of equity securities of an issuer (the "5% Owners"). "Beneficial ownership", as defined by Rule 13d-3, refers to the power to vote, to direct the voting of, dispose of, or direct the disposition of a security. A "covered class of equity securities" typically refers to a voting class of equity securities registered under the Exchange Act.

These reporting obligations apply to 5% Owners regardless of their location. This includes 5% Owners residing overseas and 5% Owners of foreign private issuers whose securities are registered under Section 12 of the Exchange Act.

The amended rules will take effect 90 days after publication in the Federal Register, except that:

- compliance with the revised Schedule 13G filing deadlines will not be required before September 30, 2024; and

- compliance with the new XML filing format for Schedules 13D and 13G will not be required until December 18, 2024.

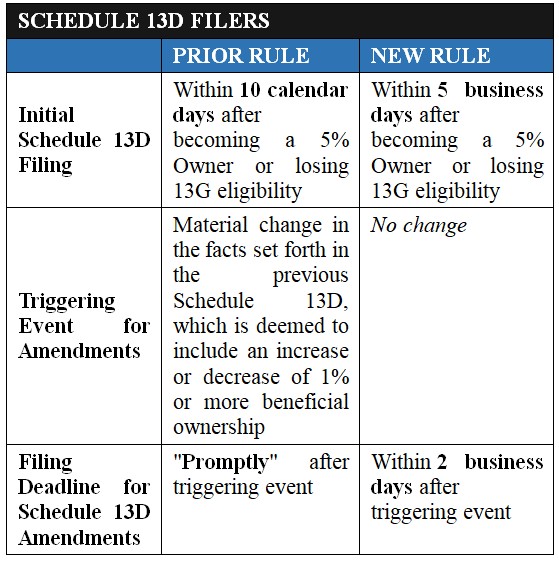

Amendments to Schedule 13D Filing Deadline

The Final Amendments make two key changes to the filing deadlines under Rule 13d-1:

- They reduce the deadline for filing an initial Schedule 13D from 10 calendar days to five business days after crossing the 5% ownership threshold or losing eligibility to file on Schedule 13G.

- For filing an amendment to a Schedule 13D based on a material change in the information provided in the initial Schedule 13D, the Final Amendments eliminate the current requirement for filing "promptly" and establish a firmly defined deadline of two business days after the triggering event.

The changes to the filing obligations for Schedule 13D in the Final Amendments are summarized in the table below.

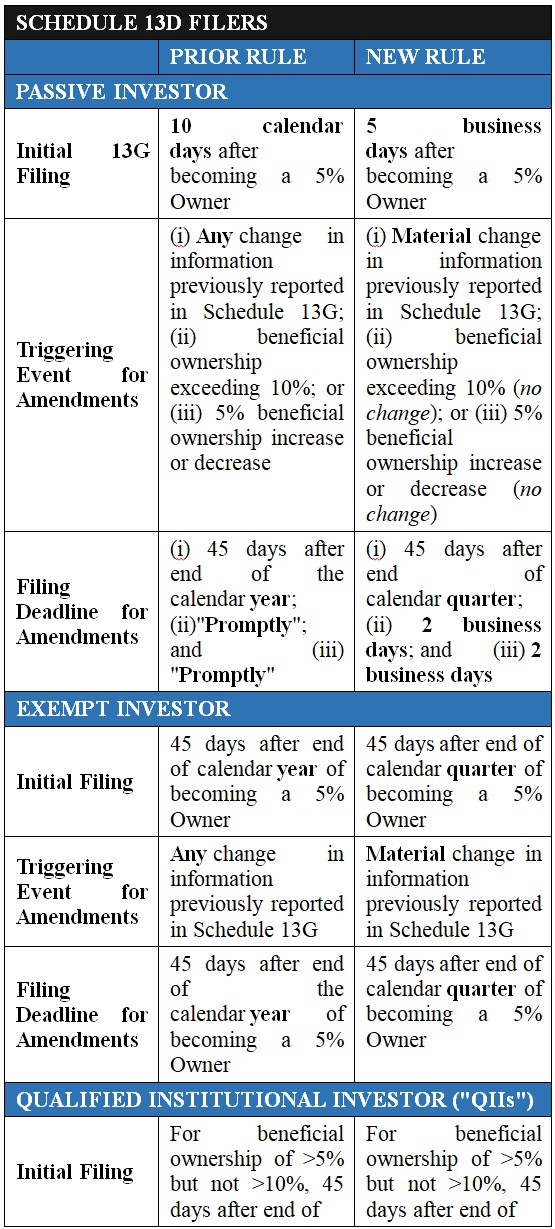

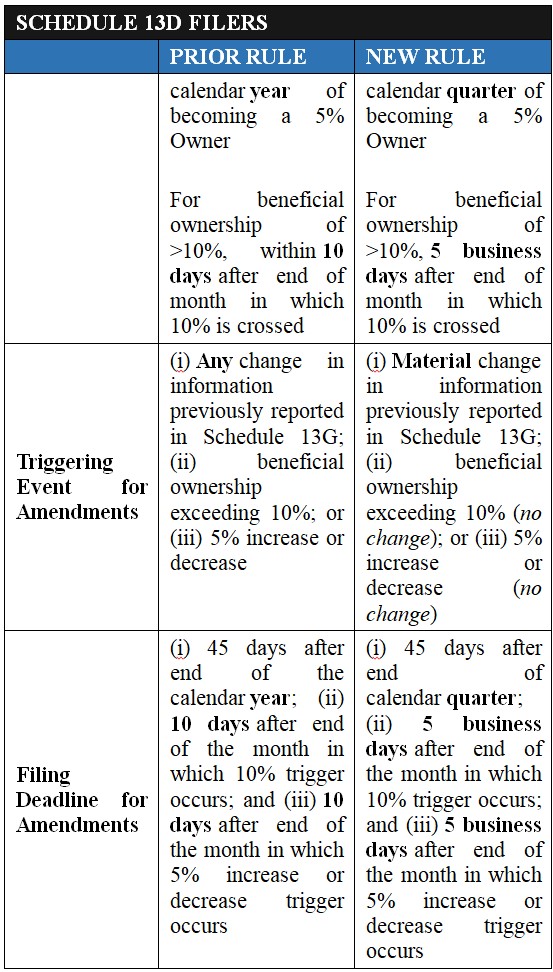

Schedule 13G Filing Deadline

For Schedule 13G filers who are Qualified Institutional Investors ("QIIs") or exempt investors, the Final Amendments make the following changes to initial filing deadlines:

- The initial filing deadline is moved from 45 days after the calendar year-end to 45 days after the end of the calendar quarter when the investor's beneficial ownership first crosses the 5%-threshold.

- QIIs are required to file their initial Schedule 13G within five business days after the end of the first month in which they cross the 10%-threshold, as opposed to the current 10-days-after-month-end deadline.

Other Schedule 13G filers, categorized as passive investors, have their initial filing deadline shortened from 10 days to five business days after crossing the 5%-threshold.

The Final Amendments also impact amendment obligations for Schedule 13G filers:

- A notable change is the addition of a materiality component to the amendment trigger. For all Schedule 13G filers, the Final Amendments require that an amendment for material changes must be filed within 45 days after the quarter in which the material change occurred.

- Upon crossing the 10%-threshold or deviating by more than five percentage points in beneficial ownership of a covered class, QIIs are required to file an amendment within five business days.

- Passive investors must file an amendment within two business days upon crossing the 10%-threshold or deviating by more than five percentage points in beneficial ownership of a covered class.

The changes to the filing obligations for Schedule 13G are summarized in the table below.

Treatment of Cash-Settled Derivatives

As part of the Final Amendments, Item 6 of Schedule 13D has been revised to provide greater clarity regarding the disclosure of interests in "all derivative securities," which includes cash-settled derivative securities that use the issuer's equity as a reference security. Additionally, the SEC has offered guidance to explain when a holder of cash-settled derivatives, other than security-based swaps, might be considered to beneficially own the underlying securities under the existing rules.

Under the new guidance, a holder of cash-settled derivatives can be deemed to beneficially own the underlying securities in the following circumstances:

- When the terms of the derivative provide the holder with any sole or shared voting or investment power over the underlying securities, whether through a contractual arrangement or otherwise.

- When the holder acquired the derivative with the intention of divesting itself of beneficial ownership over the underlying security or preventing the vesting of beneficial ownership as part of a scheme to evade the reporting requirements of Section 13(d) or (g) of the Exchange Act.

- When the holder has the right to acquire the underlying security within 60 days or acquires the right to acquire beneficial ownership of the security with a control purpose, regardless of when the right becomes exercisable.

In addition, the SEC has amended Schedule 13D to clarify that interests in all derivative securities relating to the applicable registered class, including cash-settled security-based swaps and other cash-settled derivatives, must be disclosed in Item 6 of Schedule 13D.

Guidance on "Groups" in Section 13

Sections 13(d)(3) and 13(g)(3) of the Exchange Act define a "group" as two or more persons who act together for the purpose of acquiring, holding, or disposing of issuer securities. Rule 13d-5(b) provides that when two or more persons "agree to act together" for the purpose of acquiring, holding, voting or disposing of equity securities of an issuer, the group formed thereby is deemed to have acquired beneficial ownership (as of the date of such agreement), of all equity securities of that issuer beneficially owned by any member of the group.

The SEC decided not to adopt the proposed amendment to Rule 13d-5. Instead, the SEC issued guidance to clarify its views under the existing rules.

In the SEC's guiding principles, two key holdings are emphasized:

- Common Objective is Necessary: The SEC clarified that a group is formed when there is evidence of a common purpose to acquire, hold, or dispose of issuer securities. Mere similar actions taken by two or more individuals are not conclusive evidence of group formation.

- No Express Agreement Required: The SEC reiterated that the formation of a "group" is not dependent on an express agreement. Instead, it depends on a thorough analysis of all relevant facts and circumstances. The SEC noted that circumstantial evidence can also demonstrate the existence of a group.

In addition to the guidance, the SEC adopted the rule changes that intra-group transfers of securities by group members do not trigger an acquisition of beneficial ownership by the group. For example, this applies when determining whether the 1% threshold for an amendment is met due to intra-group transfers.

Structured Data Requirements

The new rules mandate that Schedules 13D and 13G, excluding exhibits, must be submitted in a machine-readable, structured data format known as EDGAR XML filings. This move is aimed at enhancing accessibility, compilation, and analysis of disclosures for the benefit of investors and other market participants. The SEC clarified that this format would resemble other XML-based structured data formats utilized for Section 16 filings, Form 13F, and Form D. The new format may have implications for the appearance of Schedule 13D and 13G filings, as well as the time required for their preparation and submission.

This communication is intended to provide general information as a service to our clients and should not be construed as legal advice or opinions on specific facts.