Primer: SEC Issues Climate-Related Disclosure Rules

May 24, 2024

On March 6, 2024 the U.S. Securities and Exchange Commission ("SEC") adopted final rules that will require domestic and foreign registrants to include extensive climate-related information in their registration statements and periodic reports (the "Climate Disclosure Rules").

On April 4, 2024, the SEC "determined to exercise its discretion" to temporarily stay the Climate Disclosure Rules pending judicial review. The halt arises from a series of ongoing legal challenges by certain states and business groups. Despite the pause, the SEC in its stay order noted that it intends to "vigorously" defend its Climate Disclosure Rules.

Nonetheless, this primer summarizes the principal features of the Climate Disclosure Rules, and includes practical guidance for companies considering next steps for compliance in the event the Climate Disclosure Rules become implemented.

General Overview

Under the Climate Disclosure Rules, registrants, including Foreign Private Issuers ("FPI"), must disclose extensive climate-related information in their registration statements and periodic reports, including, but not limited to, Forms S-1, S-4, S-11, F-1, and F-4, Exchange Act Form 10, and Exchange Act periodic reports, such as Forms 10-K, 10-Q, and 20-F.

Registrants will be required to comply with enhanced qualitative disclosure requirements contained in a new subpart 1500 of Regulation S-K (Climate-Related Disclosure) and additional financial statement disclosure requirements contained in a new Article 14 of Regulation S-X (Disclosure of Severe Weather Events and Other Information).

These new disclosure requirements include disclosure of:

- climate-related risks that have materially impacted or are reasonably likely to materially impact a registrant;

- actual and potential material impacts of material climate related risks on a registrant;

- the manner in which the registrant's board of directors and management oversees climate-related risks and assesses and manages those risks;

- processes for identifying, assessing, and managing material climate-related risks;

- climate-related targets or goals that have materially affected or are reasonably likely to materially affect the registrant;

- a registrant's strategy to implement and reduce climate-related risks;

- various financial statement effects resulting from severe weather events or other natural conditions, and material expenditures directly related to climate-related activities as part of a registrant's strategy, transition plan, targets and goals; and

- direct and indirect Greenhouse Gas ("GHG") emissions for "Large Accelerated Filers" and "Accelerated Filers", if material to the registrant, with an attestation report requirement at either a limited or reasonable assurance level.

The Climate Disclosure Rules are intended to facilitate disclosure of "complete and decision-useful information" about the impacts of climate-related risks on registrants, and to improve the "consistency, comparability, and reliability of climate-related information for investors".

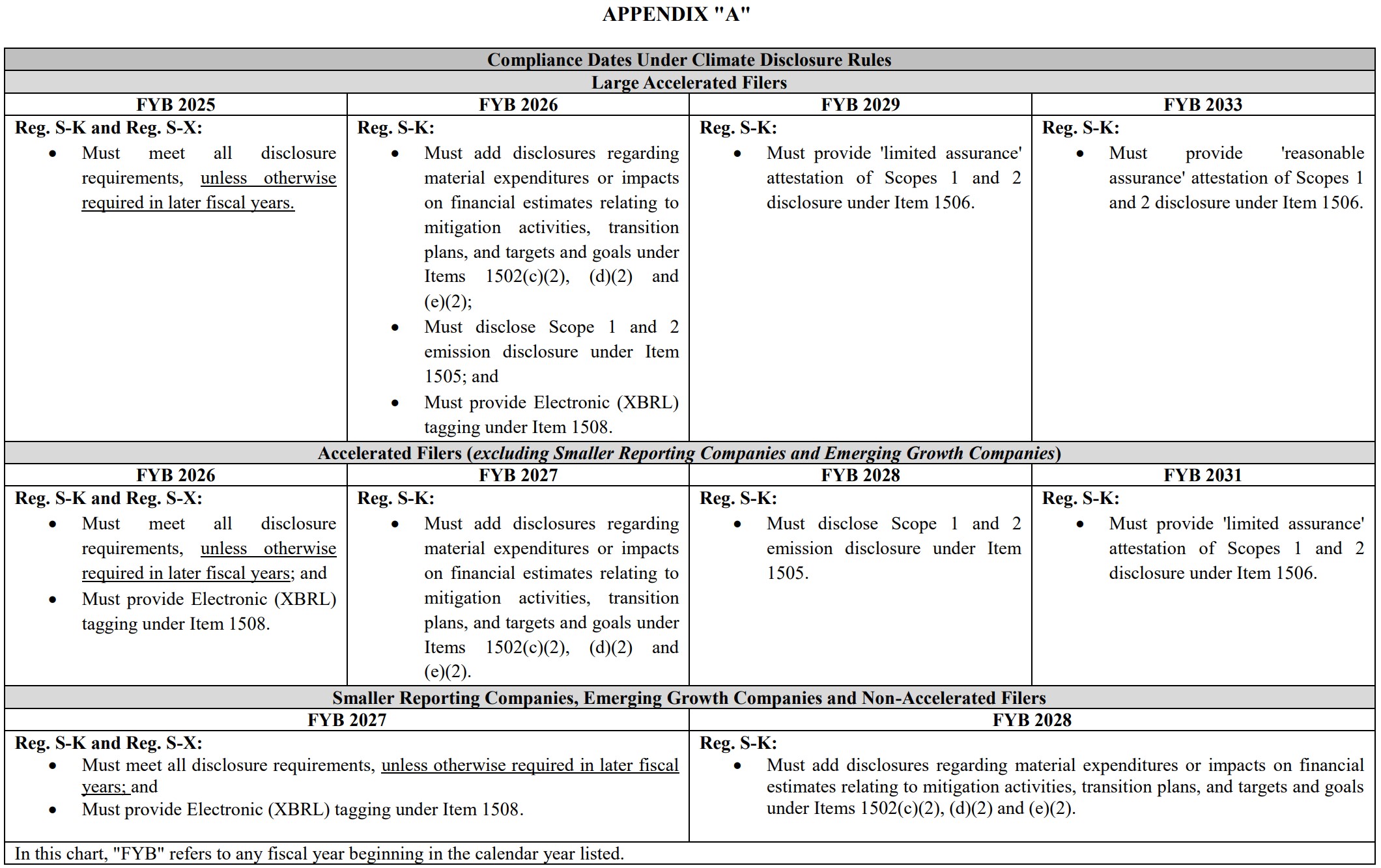

Compliance Dates

The Climate Disclosure Rules include three phase-in dates for compliance:

- the initial Climate Disclosure Rule compliance phase-in dates based on filer status;

- phase-in dates for disclosure of material expenditures and GHG reporting; and

- phase-in dates for the attestation report requirement and whether 'limited' or 'reasonable' assurance is required.

(see Appendix "A" attached to this primer for an overview of phase-in dates).

Notably, Canadian reporting issuers that use the Multijurisdictional Disclosure System are exempt from the Climate Disclosure Rules

Materiality Definition

The SEC has clarified that the definition of "materiality" used in the Climate Disclosure Rules will be consistent with existing SEC disclosure rules and market practices. Materiality refers to the importance of information to investment and voting decisions about a particular company. A matter is "material" if there is a substantial likelihood that a reasonable investor would consider it important when determining whether to buy or sell securities or how to vote, or if such a reasonable investor would view omission of the disclosure as having significantly altered the total mix of information made available.

The SEC has enumerated types of material impacts that a registrant should consider, such as impacts on: (i) business operations; (ii) products or services; (iii) suppliers, purchasers or counterparties to material contracts; (iv) activities to mitigate or adapt to climate-related risks; and (v) expenditures for research and development.

Regulation S-K Disclosure

- Disclosure of Climate-Related Risks

Item 1502(a) of Regulation S-K will require that a registrant must disclose any "climate-related risks" that have materially impacted, or are reasonably likely to have a material impact on, the registrant. "Climate-related risks" means the actual or potential negative impacts of climate-related conditions or events on a registrant’s business, results of operations, or financial condition.

In describing these material climate-related risks, a registrant must describe whether such risks are reasonably likely to manifest in the short-term (i.e., in the next 12 months) and separately in the long-term (i.e., beyond the next 12 months). Climate-related conditions and events may be affected by risks related to the physical impacts of the climate, known as "physical risks", or by risks arising from a potential transition to a lower carbon economy, known as "transition risks". Physical risks include both "acute risks", which are event-driven and may relate to shorter term severe weather events, and "chronic risks", which relate to longer term weather patterns.

Item 1502(a) of Regulation S-K also will require a registrant to detail the geographic location and nature of the properties, processes, or operations affected by these risks, and explain "the nature" of any transition risk(s). This includes specifying whether the transition risk(s) relate to regulatory, technological, market (e.g., changing consumer, business counterparty, and investor preferences), or other transition-related factors, and how those factors impact the registrant.

- Disclosure of Climate-Related Risks' Material Impact

Item 1502(b) of Regulation S-K will require a registrant to describe the "actual and potential material impacts" of the registrant’s identified material climate-related risks on its strategy, business model, and outlook. This includes describing, as applicable, (i) any material impacts on products or services, suppliers, purchasers, or counterparties to material contracts (to the extent known or reasonably available); (ii) activities to mitigate or adapt to climate-related risks; and (iii) expenditure for research and development.

Item 1502(c) of Regulation S-K will require a registrant to discuss whether and how it incorporates the climate-related risk impacts into its "strategy, financial planning, and capital allocation". This includes, as applicable, whether the identified impacts have been integrated in the registrant’s business model or strategy (including whether and how resources are being used to mitigate climate-related risks), and how any targets, goals, or transition plans required to be disclosed relate to its business model or strategy.

Item 1502(d)(1) of Regulation S-K will, in turn, require a discussion of how any identified material climate-related risks have "materially impacted or are reasonably likely to materially impact" a registrant’s business, results of operations, or financial condition.

For Annual Reports or Registration Statements Item 1502(d)(2) of Regulation S-K will require a quantitative and qualitative description of "the material expenditures incurred and material impacts on financial estimates and assumptions" that, in management’s assessment, directly result from activities to mitigate or adapt to climate-related risks. This requirement applies to Accelerated Filers for fiscal year beginning ("FYB") 2027 and to Smaller Reporting Companies, Emerging Growth Companies and Non-Accelerated Filers for FYB 2028.

- Climate Related Risks, Governance and Management Disclosure

Item 1501 of Regulation S-K will require a registrant to disclose certain information concerning its board of directors’ oversight of climate-related risks, and management’s role in assessing and managing those risks.

In regards to board oversight, the Climate Disclosure Rules require disclosure regarding:

- the identity of any board committee or subcommittee responsible for the oversight of climate-related risks;

- the processes by which the board, or board committee, or subcommittee becomes informed about climate-related risks; and

- whether and how the board oversees progress of the registrant against any climate-related target, or goal, or transition plan, if the registrant has disclosed any such targets, goals, or plans pursuant to the Climate Disclosure Rules.

As to management’s role in assessing and managing a registrant’s material climate-related risks, the Climate Disclosure Rules require disclosure regarding the following non-exclusive list of matters:

- whether and which management positions or committees are responsible for assessing and managing climate-related risks, and the relevant expertise of such position holders or committee members, in sufficient detail to fully describe the nature of such expertise;

- the processes by which such positions or committees assess and manage climate-related risks; and

- whether such positions or committees report information about such risks to the board of directors, or to a board committee or subcommittee.

- Disclosure of Risk Management

Item 1503 of Regulation S-K will require a registrant to describe any processes it has for identifying, assessing, and managing material climate-related risks. The registrant will be required to make disclosures on a range of topics (including the following non-exclusive list of disclosure items) regarding how the registrant:

- identifies whether it has incurred, or is reasonably likely to incur, a material physical or transition risk;

- decides whether to mitigate, accept, or adapt to the particular risk; and

- prioritizes whether to address the climate-related risk.

Additionally, if the registrant is managing a material climate-related risk, it must disclose whether and how any of the processes disclosed pursuant to Item 1503 of Regulation S-K have been integrated into its overall risk management system or processes.

Climate Regulation Policy-Specific Disclosure

- Targets and Goals

Under Item 1504 of Regulation S-K, a registrant must disclose any climate-related target or goal that has materially affected, or is reasonably likely to materially affect, the registrant’s business, results of operations, or financial condition. The registrant also must provide additional information or explanation necessary to understand the material impact or reasonably likely material impact of the target or goal, including, but not limited to, a description of:

- the scope of activities included in the target;

- the unit of measurement;

- the defined time horizon by which the target is intended to be achieved, and whether the time horizon is based on one or more goals established by a climate-related treaty, law, regulation, policy, or organization;

- whether the registrant has established a baseline for the target or goal, the defined baseline time period and the means by which progress will be tracked; and

- a qualitative description of how the registrant intends to meet its climate-related targets or goals.

A registrant will also be required to update this disclosure each fiscal year by describing the actions taken during the year to achieve its targets or goals, including a description of:

- any progress made toward meeting the target or goal and how any such progress has been achieved;

- any material impacts to the registrant’s business, results of operations, or financial condition as a direct result of the target or goal or the actions taken to make progress toward meeting the target or goal; and

- any material expenditures and material impacts on financial estimates and assumptions as a direct result of the target or goal or the actions taken to make progress toward meeting the target or goal (expressed both quantitatively and qualitatively).

If the registrant has used carbon offsets or renewable energy credits or certificates ("REC") as a material component of the registrant’s plan to achieve its climate-related targets or goals, then, in addition to any financial information required to be disclosed about the carbon offset or REC required under the new Article 14 of Regulation S-X, the registrant must also separately disclose:

- the amount of carbon avoidance, reduction or removal represented by the offsets or the amount of generated renewable energy represented by the RECs;

- the nature and source of the offsets or RECs;

- a description and location of the underlying projects;

- any registries or other authentication of the offsets or RECs; and

- the cost of the offsets or RECs.

- Transition Plan

A "transition plan" means a registrant's strategy and implementation plan to reduce climate-related risks, which may include a plan to reduce its GHG emissions in line with its own commitments, or with commitments of jurisdictions within which it has significant operations.

If a registrant has adopted a transition plan to manage a material transition risk (as described in Section IV (i)), Item 1502(e)(1) of Regulation S-K ) the registrant must:

- describe the plan; and

- update its annual report disclosure (Form 10-K or 20-F) about the transition plan each fiscal year by describing any actions taken during the year under the plan, including how such actions have impacted the registrant’s business, results of operations, or financial condition, to allow for an understanding of the registrant’s progress under the plan over time.

For FYB 2027 for Accelerated Filers and FYB 2028 for Smaller Reporting Companies, Emerging Growth Companies and Non-Accelerated Filers, Item 1502(e)(2) of Regulation S-K will further require quantitative and qualitative disclosure of material expenditures incurred, and material impacts on financial estimates and assumptions resulting from the disclosed transition plan.

- Scenario Analysis and Carbon Price

Under Item 1502(f) of Regulation S-K:

- if a registrant uses scenario analysis to assess the impact of climate-related risks on its business, results of operations, or financial condition; and

- if, based on the results of such analysis, the registrant determines that a climate-related risk is reasonably likely to have a material impact on its business, results of operations, or financial condition,

then the registrant will also be required to describe each such scenario, including a brief description of the parameters, assumptions, and analytical choices used, and the expected material impacts on the registrant under each such scenario.

Item 1502(g) of Regulation S-K will require that if a registrant’s use of an internal carbon price (an estimated cost of carbon emissions used internally within an organization) is material to how it evaluates and manages a material climate-related risk, the registrant will be required to disclose:

- its internal price per metric ton of carbon dioxide equivalent (CO2e); and

- its internal total price, including how the total price is estimated to change over short- and long-term periods.

If the registrant uses more than one internal carbon price to evaluate and manage a material climate-related risk, such registrant must provide the disclosures listed above for each internal carbon price and also disclose the reasons for using different prices. Furthermore, if the scope of entities and operations involved in the use of an internal carbon price is materially different from the organizational boundaries used for the purposes of calculating the registrant’s GHG emissions disclosure under Item 1505 of Regulation S-K (as discussed in Section VI of this primer), the registrant must also include a brief description of such difference.

Regulation S-K Greenhouse Gas Emission Disclosure

Accelerated Filers and Large Accelerated Filers are required to disclose, if material, their Scope 1 GHG emissions and their Scope 2 GHG emissions for the registrant's most recently completed fiscal year and, if the registrant has previously disclosed such emissions, the historical fiscal year(s) included in the filing. Scope 1 GHG emissions include direct emissions from operations owned or controlled by the registrant. Scope 2 GHG emissions include indirect emissions from the generation of purchased electricity, steam, heating, and cooling consumed by the registrant on a phased-in basis.

A registrant will need to describe its methodology, significant inputs, and significant assumptions used to calculate its disclosed GHG emissions. The description of the registrant's methodology must include:

- the organizational boundaries used to calculate the registrant's disclosed GHG emissions, including the method used to determine those boundaries;

- a brief discussion of the operational boundaries used by the registrant, including the approach to categorization of emissions and emissions sources; and

- a brief description of the protocol or standard used to report the GHG emissions, including the calculation approach, the type and source of any emissions factors used, and any calculation tools used to calculate the GHG emissions.

While GHG emissions disclosures will be required in annual reports filed with the SEC, the Climate Disclosure Rules allow registrants to provide such GHG emissions disclosures on a delayed basis, no later than the due date of the second quarter for Form 10-Q filers, and for FPIs, no later than 225 days after the end of fiscal year to which GHG emissions metrics disclosure relates.

Under Item 1506 of Regulation S-K, registrants required to disclose Scope 1 and/or Scope 2 emissions will be required to include an attestation report in the same filing covering the disclosure of such emissions, and provide certain related disclosures about their attestation service provider for the attestation report.

The Climate Disclosure Rules introduce two levels of assurance: "limited" and "reasonable". The SEC, in its proposal release, stated that in a "limited" assurance engagement, the service provider's objective is to conclude about whether it is aware of any material modifications necessary to ensure that the Scope 1 emissions and/or Scope 2 emissions disclosure are accurate and aligned with the applicable criteria. In such engagements, the service provider's conclusion provides negative assurance, indicating no identification of significant misstatements.

By contrast, in a "reasonable assurance" engagement, the service provider's objective is to express an opinion on whether the subject matter is free from material misstatement and in accordance with the relevant criteria in all material respects.

Smaller Reporting Companies, Emerging Growth Companies and Non-Accelerated Filers do not have assurance attestation requirements under the Climate Disclosure Rules. The Climate Disclosure Rules require both Large Accelerated Filers and Accelerated Filers to obtain "limited" assurance for FYB 2029 and FYB 2031, respectively. Large Accelerated Filers are required to further transition to "reasonable" assurance for FYB 2033.

Item 1506 of Regulation S-K will require registrants to provide an attestation report in the same filing that contains GHG emissions disclosure to which the report relates.

Regulation S-X Financial Statement Disclosures

Article 14 to Regulation S-X will require a registrant to disclose in a note to the financial statements for the most recently completed fiscal year (and to the extent previously disclosed or required to be disclosed, for the historical fiscal year(s) for which audited consolidated financial statements are included in the filing), certain specified climate-related financial statement effects of severe weather events and other natural conditions and related information.

- Severe Weather Elements and Natural Conditions

The Climate Disclosure Rules provide a prescriptive method for disclosing climate-related financial effects. Registrants will be required to disclose if either of the following thresholds are met or exceeded:

- Expenditures expensed as incurred and losses resulting from severe weather events and other natural conditions. Registrants must disclose the aggregate amount of expenditures expensed as incurred and losses, excluding recoveries, incurred during the fiscal year resulting from severe weather events and other natural conditions, if the aggregate amount of expenditures expensed as incurred and losses equals or exceeds 1% of the absolute value of income or loss before income tax expense or benefit for the relevant fiscal year. Disclosure is not necessary, however, if the aggregate amount of expenditures expensed as incurred and losses is less than $100,000 for the relevant fiscal year.

- Capitalized costs and charges resulting from severe weather events and other natural conditions. Registrants must disclose the aggregate amount of capitalized costs and charges, excluding recoveries, incurred during the fiscal year as a result of severe weather events and other natural conditions, if the aggregate amount of the absolute value of capitalized costs and charges equals or exceeds 1% of the absolute value of stockholders’ equity or deficit at the end of the relevant fiscal year. Disclosure is not necessary, however, if the aggregate amount of the absolute value of capitalized costs and charges is less than $500,000 for the relevant fiscal year.

A capitalized cost, expenditure expensed, charge, loss, or recovery is deemed to result from a severe weather event or natural condition when the event in question is a "significant contributing factor" in incurring the capitalized cost, expenditure expensed, charge, loss, or recovery. If a registrant chooses to disclose this information, it must also specify the total amount of recoveries recognized during the fiscal year as a result of severe weather events and other natural conditions for which capitalized costs, expenditures expensed, charges or losses are disclosed, and it must identify where the recoveries are presented in the income statement and the balance sheet.

- Carbon Offsets and RECs

Article 14 of Regulation S-X also requires financial disclosures related to carbon offsets and REC used as a "material component" by registrants to achieve their climate-related targets or goals. The Climate Disclosure Rules require registrants to disclose (i) the aggregate amount of RECs expensed, (ii) the aggregate amount of RECs recognized and (iii) the aggregate amount of losses incurred on RECs. The registrant must identify where the expenditures expensed, capitalized costs, and losses are presented in the income statement and the balance sheet. The registrant must also include the beginning and ending balances of the capitalized carbon offsets and RECs for the fiscal year and the registrant's accounting policy for carbon offsets and RECs.

- Effects of Severe Weather and Natural Conditions on Financial Estimates and Assumptions

Registrants will be required to disclose whether the estimates and assumptions the registrant used to produce its consolidated financial statements were materially impacted by exposures to risks and uncertainties associated with, or known impacts from, severe weather events and other natural conditions, or any climate-related targets or transition plans disclosed by the registrant. If the registrant makes such a disclosure, it must provide a qualitative description of how the development of such estimates and assumptions were impacted by such events, conditions, targets, or transition plans.

- Contextual Information

For each of the above disclosures, the registrant must also provide contextual information, including disclosure on significant inputs and assumptions used, significant judgments made, other information that is important to understand the financial statement effect and, if applicable, policy decisions made by the registrant to calculate the specified disclosures.

Filing Format

For Accelerated Filers in the FYB 2026 and for Smaller Reporting Companies, Emerging Growth Companies and Non-Accelerated Filers for the FYB 2027, disclosure under the New Climate Disclosure Requirements must be in XBRL format, per Regulation S-T standards.

Liability and Enforcement

Under Item 1507 of Regulation S-K, certain climate-related disclosures will constitute "forward-looking statements" and fall under the protections of the Private Securities Litigation Reform Act of 1995 ("PSLRA") safe harbor. The Climate Disclosure Rules extend the PSLRA safe harbor to forward-looking statements (excluding historical facts) in the disclosures pertaining to transition plans (Item 1502(e)), scenario analysis (Item 1502(f)), use of internal carbon pricing (Item 1502(g)), and targets and goals (Item 1504). The Climate Disclosure Rules also make clear that these statements, even if made in connection with certain transactions and disclosures currently excluded from the PSLRA safe harbor (e.g., registrants conducting an initial public offering), will nevertheless remain eligible for protection under the PSLRA safe harbor.

Next Steps

Registrants should consider taking the following actions in response to the Climate Disclosure Rules to help mitigate potential enforcement risks:

- developing accounting policies in coordination with external auditors to enable reporting information required by Article 14 of Regulation S-X;

- creating a materiality matrix and processes to document materiality determinations, including addressing privilege concerns;

- assessing sufficiency of existing disclosure and procedures in relation to the Climate Disclosure Rules;

- beginning to assess materiality and review available data for areas where data gathering and reporting functions will need expanding;

- planning to engage attestation firms and advisers as needed; and

- reviewing existing executive and board risk management and oversight practices for climate-related risks against disclosure requirements to identify any changes to be made.

This communication is intended to provide general information as a service to our clients and should not be construed as legal advice or opinions on specific facts.